How the Cost-of-Living Crisis Is Impacting Business and Trading

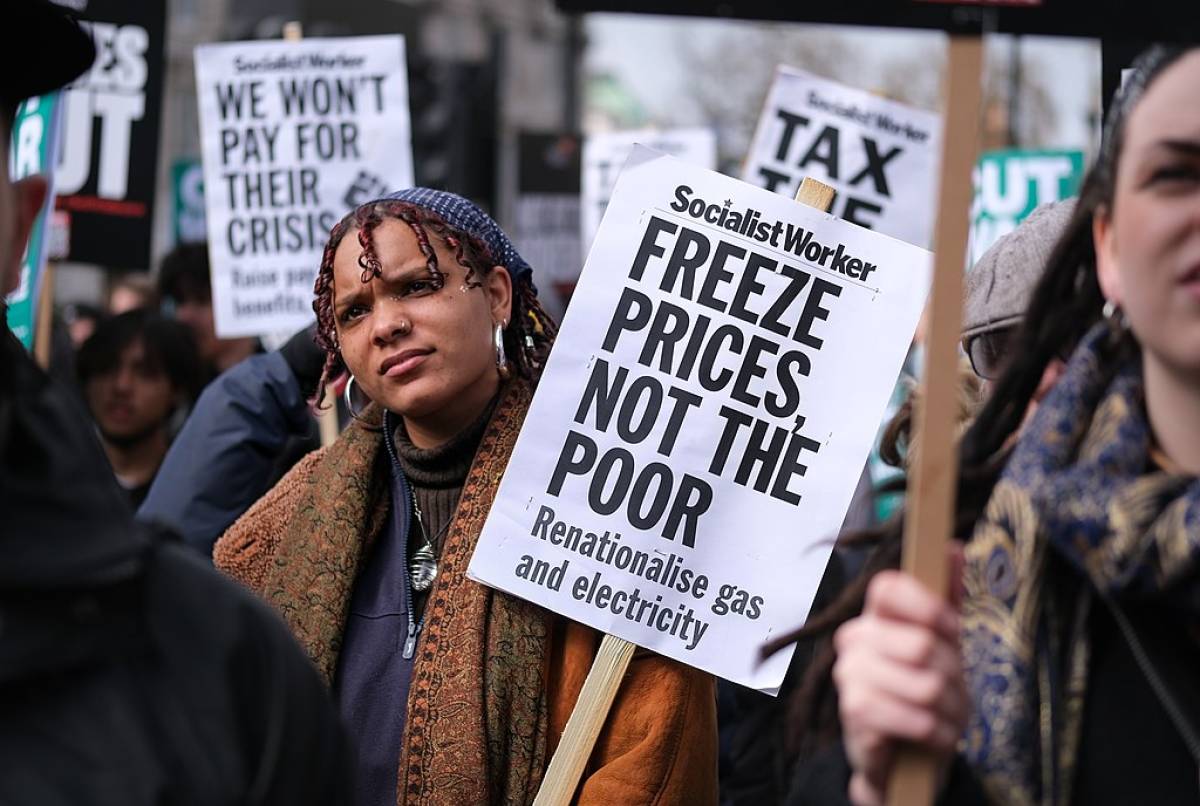

A protester opposite Downing Street listens to one of the speakers on a day of action over the surging cost of living. One of the speakers was Jeremy Corbyn. He reminded the crowd of the cruelty of austerity resulting in hunger and death in a country which was the fifth richest in the world. Photo: Alisdare Hickson / Wikimedia.

The cost-of-living is sky-high worldwide, with the crisis hammering households and affecting trading more than we have seen in the last 10 years. Inflation is rife at an all-time high of 13.1%.

The strain that high costs are bringing is directly impacting households and businesses alike. In the UK, the value of the British pound, has dropped dramatically, hitting a record low below the US Dollar. Many people across the country are just living through this harsh economic climate without really understanding the implications and how this all came about.

For businesses and traders who work off the changes in the stock market, it is imperative to understand the basics of the cost-of-living crisis and how it might be affecting you and your trading:

What Is the Cost-of-Living Crisis?

The ‘cost of living crisis’ essentially means the fall in real disposable incomes after necessary expenses are paid.

The price of the most essential goods and services in the UK has increased faster than the average household income, and as a result, there is a fall in this disposable expenditure.

If you have been food shopping recently, for example, you have probably noticed that foods have increased in price in comparison to when you may have bought them before 2021.

What Has Influenced the Current Cost-of-Living Crisis?

Environmental factors have had a huge impact on the economy, as have other global events you know of, but may not have yet grasped their long-term effects.

Two of the biggest factors that have also contributed to the cost-of-living crisis include:

I. Covid-19

One of the first and most detrimental effects of the cost of the living crisis was the impact covid-19 had on businesses and trading. At the height of the pandemic, businesses were either forced to close or voluntarily closed for the safety of communities.

The sudden drop in demand and economic activity was detrimental to many businesses that had to close due to the circumstances. However, this also resulted in the imbalance of supply and demand.

As we headed into more normal times this year, demand has shot up whilst global supply chains have been disrupted and unable to meet demands. As a result of this, we are now facing huge price increases which ultimately have been influential for the cost-of-living crisis.

II. Russia's Invasion of Ukraine

Before Russia invaded Ukraine, a large amount of the EU's energy supply was being imported from Russia. Now that the UK and other NATO countries have issued sanctions against Russia, there has been a dramatic hike in energy prices which has made many countries look elsewhere for their energy supplies.

This does correlate also with the effects of the pandemic, as post-lockdown life and the opening of businesses lead to increased demand for energy supplies to commercial spaces, which the supply could not meet.

Opportunities and Impact of the Crisis on Stock Trading

At this stage of the economy (as we ease into a recession), you could start seeing many traders selling their stocks. Whether it's just for contingency or they are losing too much money, traders tend to slow down on their investments especially when there is too much risk involved.

Any good trader knows that any investment is a risk, but in this economy, people pulling their money out of the markets will overall reduce the value of it. It is essentially a domino effect as the more coins in crypto, for example, become available, the less value they will hold.

On the other hand, it is commonly known that the time of the recession is the most valuable time to also be investing. If you have a good understanding of the markets, it might be smart to make smaller investments across different online currencies if you can predict their increase in coming years.

Look at the people who invested in bitcoin after the 2008 financial crisis, they are some of the richest people in the world right now!

Tips to Avoid Trading Losses During the Crisis

During this fragile time, do not make the mistakes that other traders have made in the past and make multiple high-risk investments. As already mentioned, once we reach the peak of the recession, it might then be worth reviewing the markets and making educated investments.

Digital currencies are going to be extremely influential as we reach new heights and rely more on technology, and they shouldn’t be completely neglected despite the state of the economy.

One thing to keep in mind is that a rise in fraud cases with digital currencies is rampant during times of economic struggles. Things like NFT frauds have become the newest and most popular ways investors have been targeted due to the lack of knowledge and regulation in such markets.

As people struggle economically, the rate of crime tends to rise, which is evident with the sharp rise in cyber fraud cases. Investing should not be put on hold however, but keep in mind that the cost-of-living crisis will have long-term adverse effects on the economy.

Spread your risks and make various investments, either through digital currency or perhaps more traditional long-term investments such as real estate, stocks, bonds, and mutual funds.