Best Investment Tips for Experienced (and Not Too Experienced) Investors

When you’ve been learning about investing for a little bit and you’re starting to feel comfortable with your knowledge, you’ll start to notice that lots of generic tips aren’t as helpful anymore.

So much financial advice is catered to beginners, and it can be difficult to filter the low-level tips out and find investment ideas you haven’t heard before. Then, when you do manage to get your hands on new advice, you may find you’ve overshot it completely and landed on advanced material that’s far out of your experience range, which isn’t helpful either!

So, where does the middle-of-the-road investor go for expert insight that can meet them where they are? Well, we’ve compiled insights from billionaire investors that are not only helpful to the average person, but also quite useful even after you’ve nailed down the basics.

Top Investment Tips from Billionaires

Here are some of the most helpful and unique investment tips from billionaires:

1. Get comfortable changing your goals

A common misconception is that in order for goals to be effective, they have to remain constant. While it’s important to set specific and attainable goals, you also should be able to understand when it’s appropriate to move your own goalposts so you never stop challenging yourself.

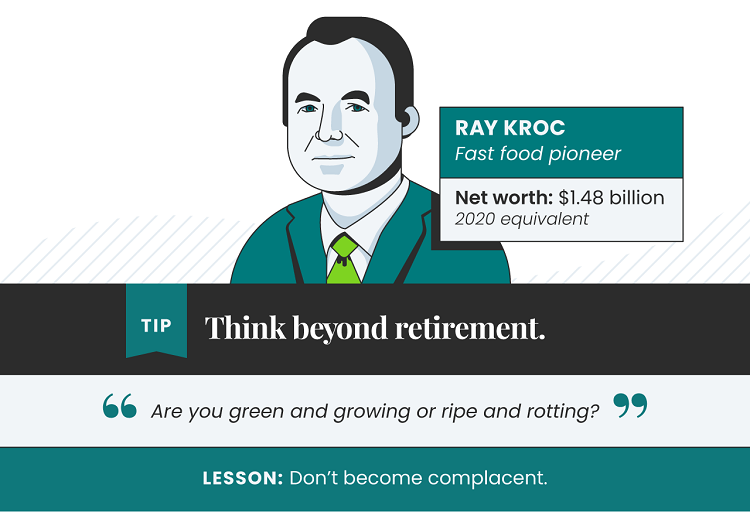

Ray Kroc (the founder of McDonald’s) liked to put it this way: “If you’re green, you’re growing; as soon as you’re ripe, you start to rot.”

Pushing yourself outside your comfort zone isn’t a one-time thing. As humans, we naturally adjust to our surroundings which means what was once a challenge zone will become a safe home base eventually.

As an investor, it’s important to be consistently evaluating your objectives to ensure that you’re never resting on your laurels. You should always be looking ahead, even when it comes to your very longest-term goal.

2. Get inspiration from outside the investment world

One thing that can happen once you’ve learned enough about basic investment to feel comfortable is you can start to wonder what’s “next.” It’s difficult to set long-term goals when you’re struggling to understand what you should be reaching for. If you’re finding yourself simply setting higher and higher monetary goals, it’s time to think outside of the box.

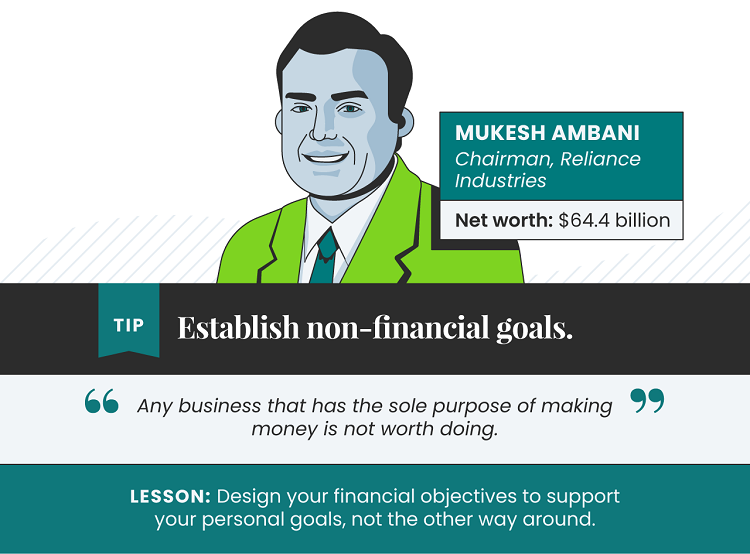

Chairman of Reliance Industries Mukesh Ambani has been quoted as saying, “Any business that has the sole purpose of making money is not worth doing.” That’s true for the business of being an individual, too! Never lose sight of what you’re investing for. What are your life goals? What impact do you want to have on the world? What do you want to be known for?

By answering these questions, you can gain some creative insight into potential ways to advance your investment practice as well. If you’ve always wanted to travel, consider leveling up your portfolio with real estate. Purchase rental properties in places you’ve always dreamed of going, and you’ll have a place to stay when it’s time to take off!

Perhaps you’re an animal lover; look for equity investments in small businesses in the veterinary or animal care industry. Whatever your passion, you can align your investments in that direction in order to be personally and financially fulfilled.

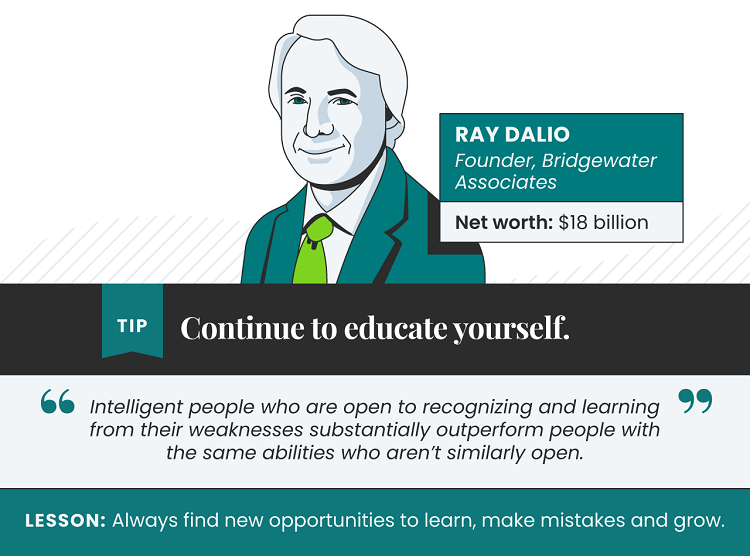

3. Never stop educating yourself

A tough pill to swallow is that part of the reason intermediate investment advice is less available is that it’s harder to package into posts and articles. The information you seek is more likely to be found in books, lectures, and online courses. It may have been a while since you were last in school, but don’t let that stop you!

The smartest investors take a lifelong learner approach — to investment and to topics that are totally unrelated. People who enjoy learning for learning’s sake are far more successful than those with a fixed mindset.

Take for example Bridgewater Associates founder Ray Dalio, who writes about this concept at length in his book Principles. He tells a story about having taken skiing lessons from an instructor who had also taught Michael Jordan the same skill.

The instructor told Dalio that Jordan, who was already a champion basketball player and one of the greatest athletes of all time, was truly thrilled to have the experience to learn a new skill and feel like a beginner again. The instructor could see that Jordan not only endured his mistakes, but actively enjoyed making them and improving as a result.

No matter how much of an expert you become, never forget to be a beginner at something. It’s great practice for maintaining a growth mindset, plus it instills a sense of humility and confidence that will make you a better leader, colleague, and investor as a result.

These tips are a start — now take this starting point and turn it into a lifelong enthusiasm for knowledge!