5 Essential Tips to Prepare for the Tax-Filing Season

The tax-filing season typically falls between January 1st and April 15th each year. Sometimes, extensions for tax filing may be given but that would be under rare circumstance, such as Covid-19.

While the tax-filing period may seem lengthy, it’s always best to start as early as possible. You’ll save time and money, as well as avoid unnecessary stress and late filing penalties by preparing in advance.

Let’s look at five of the best tips you can use to prepare for the tax-filing season.

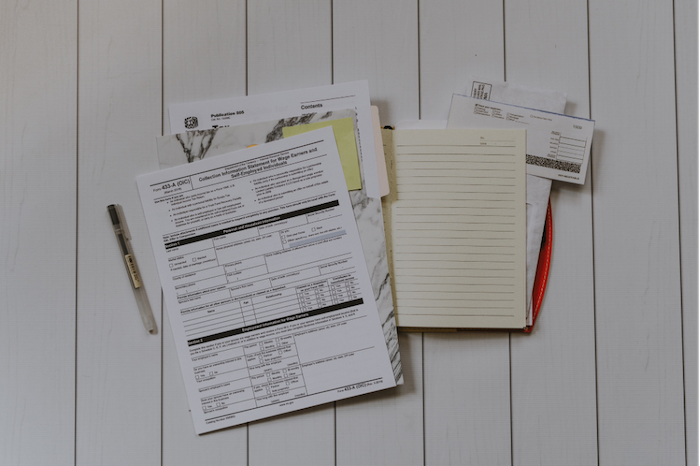

1. Organize Your Documents and Records

Make the filing process easier and faster by taking time to organize all of your financial records and tax documents.

A great starting point is evaluating your prior year’s tax return. This will help you to quickly determine your credits reported, previous income, and deductions.

You can use the IRS online portal or log into the tax software provider you used from the previous year to request and retrieve a copy of your prior tax return.

If you worked with a tax professional or Certified Public Accountant (CPA), then you were probably given a copy of your return when you first filed it. When given important documents as such, it’s crucial that you take time to safely secure them for times like these.

Evaluating your previous tax returns will ensure you have the proper documentation needed to file for the current year.

While each tax situation is unique to each individual, there are a few common tax forms and records that most people should have available before filing their tax return:

- Employees - Wage and Tax Statement (W2)

- Self-employed and freelancers - Income for Non-Employee Compensation (1099- NEC), Payment Card and Third Party Network Transactions (1099-K)

- Unemployed people - Certain Government Payments (1099-G)

- College students and graduates - Tuition Statement (1098-T), Student Loan Interest Statement (1098-E)

- Investors - Dividend Income (1099-DIV), Sale of Property (1099-S), Partnership or S-Corporation Income (Schedule K-1), Rental Income (1099-MISC)

- Homeowners - Mortgage Interest Statement, Real Estate Taxes

- Charitable donors - Charitable Statements

- Retirees - Social Security Benefit Statement (SSA-1099), Distributions From Pensions, Annuities, Retirement, etc. (1099-R)

- Recipients of the Economic Impact Payments (aka stimulus payments) - First Stimulus Payment (Notice 1444), Second Stimulus Payment (Notice 1444-B)

2. Create an Online Tax Account

You can avoid having to contact the agency by phone call or email by choosing to set up an online tax account with the IRS. This is a simple and convenient way to obtain your tax documents when you need them.

Your online account will also help you to set up payment arrangements, check payment balances, and view prior-year tax returns and reported tax forms.

While this feature does not allow you to electronically file your tax return, it still comes in handy for sourcing the documents you need.

3. Decide on CPA or DIY

While filing your own taxes is an option that anyone can choose, there are some cases when working with a professional is probably the best option.

Some tax situations can be complicated and in order to avoid making mistakes or feeling confused, establishing a relationship with a tax professional is a good idea.

If you’re a small business owner, investor, or freelancer, it may be best to seek the assistance of a CPA. A professional will help you learn about possible tax deductions, as well as, create tax strategies that may benefit you in the future. Taking this route will ensure all your T’s are crossed and all of your I’s are dotted.

On the other hand, if you’re only filing a basic wage and income statement with only a few deductions, filing your own taxes may be something you can handle on your own.

If you feel like you will need a tax professional’s help during tax filing season, it’s always best to establish the relationship ahead of time.

As Tax Day draws near, many CPAs will have reached their client threshold.

4. Find Free Filing Methods

You may qualify for the IRS Free File Program depending on the complexity of your tax filing situation and your income.

Typically, taxpayers who have an adjusted gross income of $72,000 or less are able to qualify for the program.

The IRS Free File Program is a partnership with the IRS and online tax software providers. Some of the providers are:

- FileYourTaxes

- Intuit

- 1040Now Corp

- Tax Act

- OnLineTaxes

- Free Tax Return

- TaxHawk

- TaxSlayer

- ezTaxReturn.com

While this program has been in existence since 2001, many people have not heard of it. The reason for that is that these programs are often not advertised. Typically, tax software providers donate these services and while the IRS estimates that 70% of taxpayers can qualify for the program, only a small amount of taxpayers actually use Free File.

Alongside the IRS Free File Program, taxpayers may also be able to qualify for the IRS Volunteer Income Tax Assistance Program (VITA). This program offers free tax-preparation assistance to qualified taxpayers, free of charge.

The taxpayers who qualify for VITA are those who make $57,000 or less per year, have a disability, or speak limited English.

Visit the IRS website to learn which VITA offices are near you today.

5. Don’t Ignore the IRS

If the IRS reaches out to you to make you aware of missing file returns, owed taxes, or any other tax filing issues, do not ignore them. More often than not, the IRS wants to work with you to resolve an issue.

Respond in writing without delay to let the IRS know that you have not online received their letter but you would also like to resolve the issue.

When contacting the IRS, be sure to use only the U.S. Postal Service, whose postmark will give your proof of timeliness. Make copies of your correspondence and keep them safe for your own records.

While many people think that receiving a letter from the IRS is the end of the matter, you should never assume that receiving a letter from the IRS means an issue is resolved. The IRS will always give you a chance to respond to their letter and initiate the first step to the solution.

If you choose not to respond to them, the IRS will have no choice but to start the collect action, which may lead to:

- Seizing of your assets

- Garnishing your wages

- Placing a lien on your house.

Bonus Tips

Bonus tip #1: Be knowledgeable.

Do your best to make yourself aware of announcements, bills, and acts surrounding the tax-filing season. While some things may not apply to you and seem irrelevant at a particular time, the very same information may be detrimental the following year.

You may notice impacts from the Build Back Better Act changes or the reconciliation bill tax. Or, you can avoid making common mistakes as a start-up by being aware of the current year's tax proposals.

The reality is, when it comes down to taxes and finances in general, it’s always best to not be left in the dark. You’ll avoid being confused and having to smooth over any unnecessary mistakes.

Spend time researching credible sources, speaking to professionals, and asking close family and friends about their experiences.

There's absolutely no need to feel lost or overwhelmed as the tax-filing season approaches. It’s simple, all you need to do is:

- Spend a bit of time organizing your documents and records from the previous year

- Learn which taxpayer category you fall under

- Create an online account with the IRS

- Decide if you should hire a professional or not

- Explore the different filing methods

- Reach out to the IRS if necessary

Bonus tip #2: Look out for tax scams and fraud.

As tax season approaches, many people receive phone calls, texts, and emails for entities claiming to be affiliated with the IRS.

It is important to note that the IRS will only correspond with you through U.S mail. The only time the IRS will not contact you via U.S mail is if you are in litigation.

In Conclusion

Whether it’s your very first time filing taxes or your 50th, the tax-filing season does not have to be stressful. Take the necessary steps to prepare ahead of time, do not hesitate to hire a professional if you think you’ll need one, and do your best to keep a personal record of everything.

Take deep breaths and don’t overthink the process. As each year goes by, you’ll become much more comfortable with filing taxes and before you know it, it’ll be a breeze.