Sole Proprietorship vs. LLC: A Guide for Choosing Your Business Structure

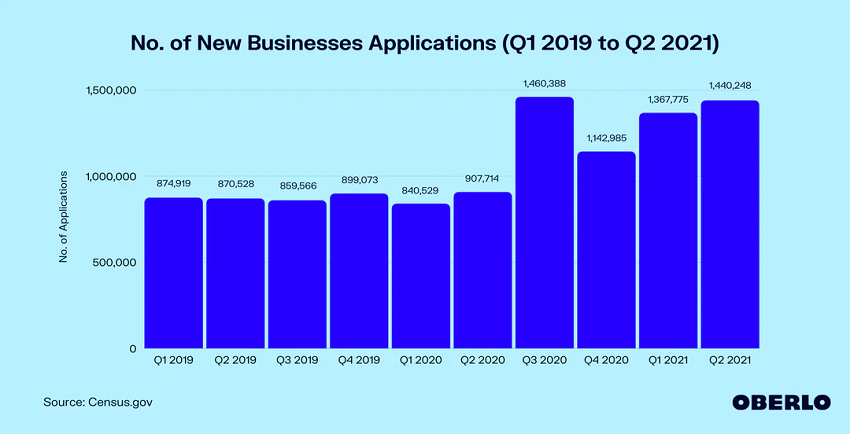

The number of new business applications filed in the US is touching a new high every quarter. Nearly 1.44 million new business applications were filed in the 2nd quarter of 2021 alone.

The situation is not so different in other places around the world. New businesses are established every day — all of them hoping to achieve success.

If you’re a new entrepreneur who’s looking to take the plunge into the world of business, you must know everything about establishing a business.

One of the most important factors that you need to consider when you’re doing that is selecting the right business structure.

There are numerous options for this: Sole Proprietorship, LLC, Partnership, and Corporation. But how do you decide which one is the best for your business?

Image via Oberlo

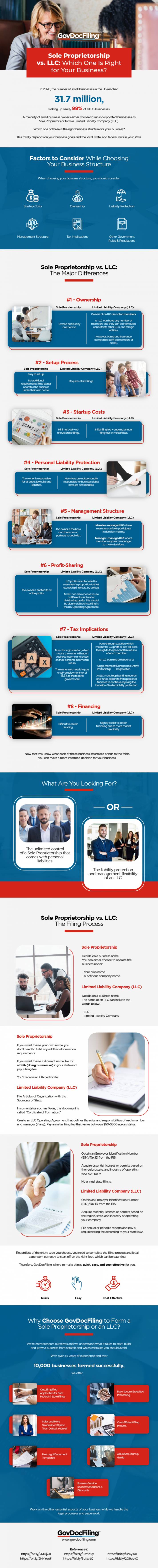

This choice of business structure is especially difficult if you’re choosing between a Sole Proprietorship and an LLC.

To help you choose the right one between a Sole Proprietorship and an LLC, we’ve put together this handy guide and key factors to consider:

Who Owns the Business?

The question of business ownership is fairly simple in Sole Proprietorships. Only an individual can own the business.

LLCs aren’t as simple. They give you more flexibility in the sense that you can have one or more owners — called members.

These owners can be individuals, other LLCs, and even foreign firms.

How Do You Form the Business?

Like business ownership, the formation process is simpler in the case of Sole Proprietorship firms. You can easily set up your Sole Proprietorship and start running your business under your name.

If you want to run it under a different name, you should consider filing for a fictitious name with a DBA (Doing Business As).

The process for LLCs is slightly different. One of the reasons for this is that an LLC is a separate legal entity, unlike a Sole Proprietorship.

You need to first file your Articles of Organization with the Secretary of State. Next, you’d have to create an LLC Operating Agreement that talks about the various roles and responsibilities of members.

LLCs are also required to pay a state filing fee for starting the business and each year after that.

How is the Business Taxed?

One of the greatest advantages of Sole Proprietorships and LLCs is that they offer pass-through taxation.

This means that the income of the business passes through to the personal income tax return of the owner. As a result, you’re spared from double taxation.

However, as you’d be the owner of the business, you’d have to pay a self-employment tax. This could be avoided in the case of LLCs, though. You can choose to get your LLC taxed as an S-Corporation to avoid this tax, but then you do have to pay corporate tax.

Which One Is Right for Your Business? Sole Proprietorship vs LLC - Infographic

To learn more about Sole Proprietorship and LLC, check out this in-depth infographic by GovDocFiling. It’ll help you make an informed decision when choosing between the two.

![9 Tips for Managing Your Online Writing Projects Efficiently [node:titile]](/sites/default/files/styles/video_thumbnail_bottom/public/open-book-laptop-online-writing-tips.jpeg?itok=rI4zR3a-)