Key Things to Know Before Starting an LLC, Including Pros, Cons & Formation

The legal structure of a company matters a lot. It impacts the tax and operational rules, which have a bearing on the overall productivity and profitability of the business.

There are many legal structures available to businesses in the U.S. These include corporations, partnerships, sole proprietorships, and limited liability companies (LLCs).

Out of these, the LLC structure is quite popular among small business owners, owing to its flexible tax structure and owner protection.

Let’s start off by taking a good look at the pros and cons of LLCs so that you can make informed decisions about forming them.

Advantages of LLCs

I.) Protection of Owners’ Assets: LLCs and their members are considered separate legal entities. In case the LLC incurs business losses and owes creditors money, the members’ assets can’t be dissolved to fulfill these financial obligations. In this way, members of LLCs enjoy protection against business creditors.

II.) Flexible Taxation: By default, LLCs are pass-through taxation entities. In simple terms, business income ”passes through” to the member's personal income for taxation. The member pays tax only once, on their personal income, the LLC itself does not pay tax.

III.) Fluid Management: Unlike corporations, LLCs don’t have to have a board of directors or hold annual general meetings. They don’t need to have any formal records of meetings and don’t require resolutions as well. This makes it easy to manage them.

Disadvantages of LLCs

I.) Self-Employment Tax: Multi-member LLC members are not considered employees of the business. Rather, they are self-employed business owners. So, they don’t enjoy tax withholding like regular employees. They need to set a contingent fund for paying self-employment taxes, which can cancel the pass-through tax benefit.

To avoid this, you can choose to get the LLC taxed as an S-Corp. Members of an S-Corp do not pay self-employment tax as they’re employees of the LLC and get a W-2. However, the LLC is then subject to corporate taxes.

II.) Short Life: LLCs are dissolved when their members change or die. They need to be reconstituted from scratch every time this happens. This can be very inconvenient if you expect the ownership to change hands often.

III.) Difficult to go Public: LLCs aren’t best suited for going public. The corporate structure is better in that regard. The same applies if you intend to issue employee shares or want to get investors on board.

But there’s a lot more to LLCs than this, including details about formation.

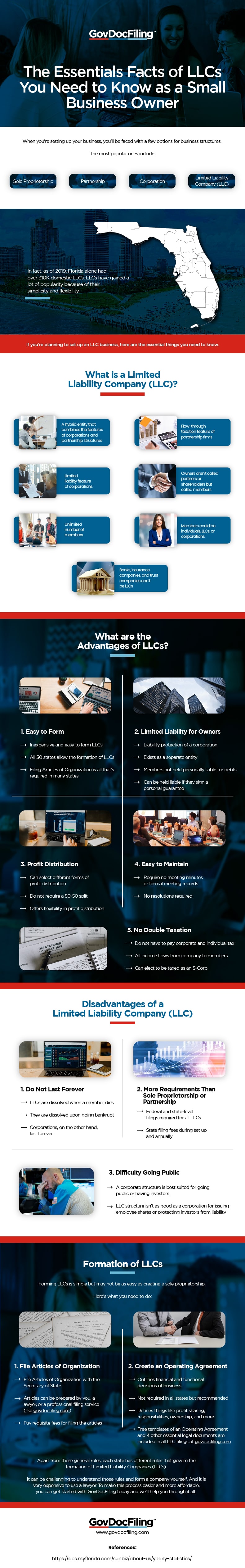

More Facts About LLCs Business Owners Should Know – Infographic

If you are planning to set up an LLC company, you need to assess your requirements well to ensure that you’re making the right decision.

Here’s an insightful infographic by GovDocFiling that reveals more information about LLCs that small business owners should know: