How to Protect Your Personal Property: Quick Guide

Your personal property is a reflection of your hard work, individuality, and lifestyle. From electronics to furniture, jewelry and collectibles, these possessions hold both monetary and sentimental value.

However, life is unpredictable and disasters can strike at any moment. To protect your cherished belongings, it's essential to understand the importance of personal property coverage and take proactive measures.

In this article, we will walk you through the steps to ensure the safety of your personal property.

But first…

Why Do You Need to Protect Your Personal Property?

Protecting personal property is essential to protect your financial investments and emotional attachments. It ensures continuity in the face of disasters and reduces stress by providing security and peace of mind.

Responsible ownership and preventive measures can also save future costs and contribute to overall well-being.

Key Steps To Safeguard Your Personal Property

Safeguarding your personal property involves a series of strategic steps that ensure both the physical and financial protection of your belongings.

From documenting major purchases to fortifying your home against theft, these actions collectively empower you to face life's uncertainties with confidence:

1. Understand Personal Property Coverage

Before delving into the specifics, it's crucial to grasp the concept of personal property coverage.

Personal property coverage is a component of homeowners' or renters' insurance that protects your belongings from various risks, such as theft, fire, or natural disasters.

This coverage offers you financial assistance to replace or repair your possessions in the event of an unfortunate incident.

2. Determine the Value of Your Personal Property

Assessing the value of your personal property is a fundamental step in protecting your belongings. Begin by creating an inventory of all your possessions, including electronics, furniture, clothing, appliances, and more.

Assign values to each item based on their current market value. This inventory will not only help you determine the appropriate level of coverage but also streamline the claims process in case of a loss.

3. Be Aware of Covered Disasters

Not all insurance policies cover the same disasters. It's essential to know which types of disasters your policy includes.

Common covered perils typically include fire, theft, vandalism, windstorms, and certain types of water damage. Some policies might also offer additional coverage for natural disasters like earthquakes and floods.

Carefully review your policy documents to understand the extent of coverage and consider purchasing additional coverage if necessary.

4. Document Major Purchases

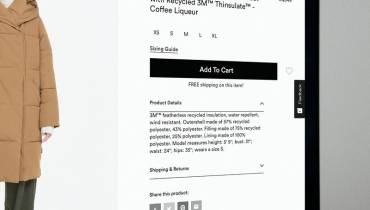

Major purchases such as electronics, jewelry, and high-end appliances should be documented separately to ensure their proper coverage.

Keep receipts, photographs, and any relevant documentation in a safe place. In the unfortunate event of a claim, this documentation will serve as evidence of ownership and value, making the claims process smoother and more accurate.

5. Protect Possessions from Theft

Theft is a common concern, and taking preventative measures can significantly reduce the risk of losing your valuable possessions.

Invest in a home security system with alarms, cameras, and motion detectors. Reinforce doors and windows with strong locks, and consider installing security film to make it harder for burglars to break in.

Additionally, avoid advertising your absence on social media when you're away from home.

6. Choose the Right Level of Coverage

Selecting the appropriate level of coverage for your possessions is a balancing act. Over Insuring can lead to unnecessary expenses, while under insuring can leave you financially vulnerable.

Take the time to assess the total value of your belongings and consult with your insurance provider to determine the coverage limits that suit your needs.

Remember that as your possessions change, your coverage should be adjusted accordingly.

Role and Benefits of Personal Property Insurance

Personal property insurance is pivotal in helping you recover after a disaster. Whether it's a house fire, a break-in, or a natural catastrophe, the financial burden of replacing your belongings can be overwhelming.

Let's delve into the multifaceted role of personal property insurance, exploring its impact on both financial security and emotional well-being:

1. Mitigating Financial Strain

In the aftermath of a disaster, the financial toll can be staggering. Personal property insurance is a buffer, providing the necessary resources to replace or repair damaged or lost possessions.

This financial support mitigates the burden of immediate expenses, allowing you to focus on recovery without the added stress of significant financial setbacks.

2. Facilitating Swift Recovery

Disasters disrupt our lives in profound ways. Personal property coverage expedites the process of regaining normalcy by ensuring you have the means to replace your belongings promptly.

This rapid response aids in rebuilding your life more efficiently, minimizing the disruption caused by the unfortunate event.

3. Enabling Possession Restoration

Your possessions are more than just objects; they hold memories, sentimental value, and a sense of identity. Personal property insurance goes beyond monetary compensation; it empowers you to restore your possessions to their pre-loss state.

This restoration process is integral to reclaiming your sense of self and continuity in the face of adversity.

4. Emotional Resilience

The emotional toll of a disaster can be overwhelming. Personal property insurance provides a vital psychological anchor, reassuring you that you have a safety net in place.

This reassurance contributes to emotional resilience, enabling you to navigate the turbulent waters of recovery with a greater sense of stability and security.

5. Alleviating Anxiety

The uncertainties following a disaster can breed anxiety and uncertainty. Personal property insurance is a countermeasure, alleviating these anxieties by assuring you that you're not alone in your journey.

This peace of mind allows you to concentrate on rebuilding your life rather than dwelling on the uncertainties of the situation.

6. Safeguarding Investments

Possessions often represent a significant financial investment accumulated over the years. Personal property insurance safeguards this investment by ensuring that you don't face a complete loss in the event of a disaster.

This protection extends to the valuable items that might be overlooked but are integral to your daily life.

7. Rebuilding with Confidence

The process of rebuilding after a disaster can feel daunting. Personal property coverage instills confidence, knowing you have the resources to face the challenges ahead.

This empowerment enables you to make decisions without the constant fear of financial instability hanging over your head.

8. Restoring Sense of Normalcy

After a disaster, the journey back to normalcy is a gradual process. Personal property insurance plays a pivotal role in expediting this journey.

By providing the means to replace your possessions, it aids in recreating the familiar environment you once cherished, which can contribute significantly to your overall well-being.

9. Family and Community Support

Personal property insurance supports you and extends its benefits to your family and community. The peace of mind you gain from having this coverage can ripple through your loved ones, fostering a stronger sense of security for all.

10. Future Preparedness

The presence of personal property insurance encourages proactive preparedness for the unforeseen. By recognizing the importance of protecting your possessions, you're more likely to implement preventative measures and maintain a comprehensive inventory, which further strengthens your resilience in the face of potential disasters.

In Conclusion

Your personal property holds both practical and emotional significance, making it imperative to protect it from unexpected events. By understanding the intricacies of personal property coverage, documenting your possessions, implementing security measures, and selecting the right level of coverage, you can safeguard your belongings effectively.

It's crucial, however, to recognize that personal property insurance goes beyond financial reimbursement; it empowers you to rejuvenate and rebound following unexpected challenges. Invest the time and effort today to ensure your personal property's more secure and resilient future.