Businesses Must Embrace Debt Sensibly to Survive Post COVID

The US government has been debating on whether a second — and final — round of the Economic Impact Payment, or simply IRS stimulus check, is needed as the country moves to reopen. This follows the $2 trillion-dollar Coronavirus Aid, Relief, and Economic Security (CARES) Act, stimulus package 1, that was passed by Congress in March, which included several programs aimed at small businesses impacted by the COVID-19 outbreak.

Starting on June 1, the Senate began deciding whether to approve the initial CARES federal stimulus bill that included cash grants, low-interest loans and payments for taxpayers, or draft an entirely new stimulus plan. It may mean waiting a few more weeks before Congress makes a final decision and passes the bill off to the president.

But there certainly is demand for a second round of stimulus payments, occasioned by the current turmoil as far as the pandemic and other issues affecting the economy are concerned. According to a WalletHub Survey, 84% of Americans want another stimulus check. President Donald Trump has himself indicated his willingness for another stimulus package.

Since every business owner is a citizen first, it’s important that if you qualify for a coronavirus stimulus payment you should do what you can to get that financial aid as quickly as possible. These stimulus programs have limited funding and are first come first served.

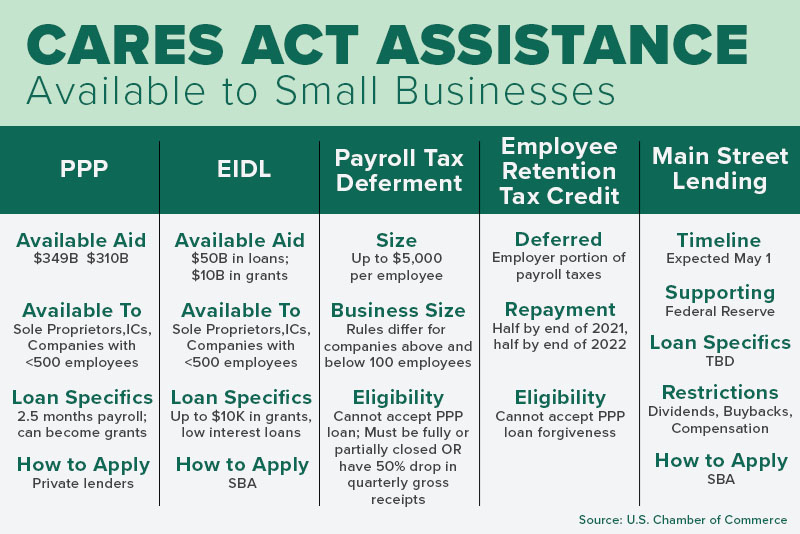

Besides that, some new federal programs aimed at helping businesses impacted by coronavirus have been very popular, including the Paycheck Protection Program (PPP) which has been massive since the application window opened on April 3.

The PPP program is an SBA loan designed to provide a direct incentive for small businesses to keep their workers on the payroll. Other noteworthy programs for small business financial assistance during COVID-19 can be seen in the U.S. Chamber of Commerce visual below:

Similarly, in the UK, lenders have also been approved to offer a Bounce Back Loan Scheme, including the Bank of Ireland UK and Skipton Business Finance. The Scheme have had a tremendous impact, with over £5billion of funding approved in the first three days.

Overall, for many businesses, these stimulus checks may be the most significant influxes of cash in the lifetime of the business, and many founders may be wondering what the best use of these funds is.

With many businesses using finance during this period to merely survive when it comes to growth post-COVID, should businesses look towards debt and fast finance as viable alternatives to Private Equity?

Reece Tomlinson, CEO of RWT Growth, a corporate advisory firm for global SMEs, offers the following advice for SMEs:

"This amount of money received by businesses across the country has been a much-needed lifeline, but it may systematically change the way businesses look at financing options. For example, debt options have been increasing in popularity over the past few years, but the Coronavirus Business Interruption Loan Scheme and Bounce Back Loan Schemes may open the eyes of other businesses and the opportunities debt offers.”

To navigate all of this moving forward, Reece offers expert advice for dealing with fast finance:

1. Change your mindset.

For many businesses, this will be the first time they have been exposed to significant levels of debt. It is crucial to shift your way of thinking away from 'all debt is bad' to one that sees it as good debt, bad debt and unsustainable debt.

2. Hold on to as much as possible.

When receiving a large sum, it may be tempting to pay off as many debts and obligations as possible but it is important to prioritise what will keep the business running. Some tax bills have been given deferrals - such as VAT - be careful that you are not spending this capital on bills that can be paid at a later date if at all possible.

3. Managing cash flow is paramount.

Every effort needs to be made to ensure the SME is not burning unsustainable levels of cash, which could otherwise cause the SME to be forced to close its doors. Receiving support in the form of this loan or debt finance should not change the need to improve the firm's cash flow.

4. Debt needs to be paid back.

This is important because the business will need to, at some point in time, be able to start making payments from the cash flows of the company. For example, if the SME borrows £250,000 via the CBILS, you can expect your future cash flows to be no less than £50,000 lower per year for a minimum of five years (assuming no interest or lender-levied charges).

Businesses should conduct an affordability test and financial model before applying to understand the viability of the debt taken on in a best and worst-case scenario.